作者:川总写量化

题图:川总写量化微信公众号

摘要

隐性多因子模型如何成为研究资产定价的重要范式?且听 Kelly and Xiu (2023) 娓娓道来。

本文继续翻译 Bryan Kelly 和修大成两位教授的 Financial Machine Learning (Kelly and Xiu 2023) 第四章(Risk-Return Tradeoffs)的剩余部分,即 4.4 到 4.6 节。(第一部分请见此处。)

再次感谢王熙和刘洋溢对内容的反馈。本翻译仅供学习交流使用,禁止一切商业行为,未经授权,禁止转载。

以下是正文部分。

4.4 复杂因子模型

4.5 高频模型

4.6 Alphas

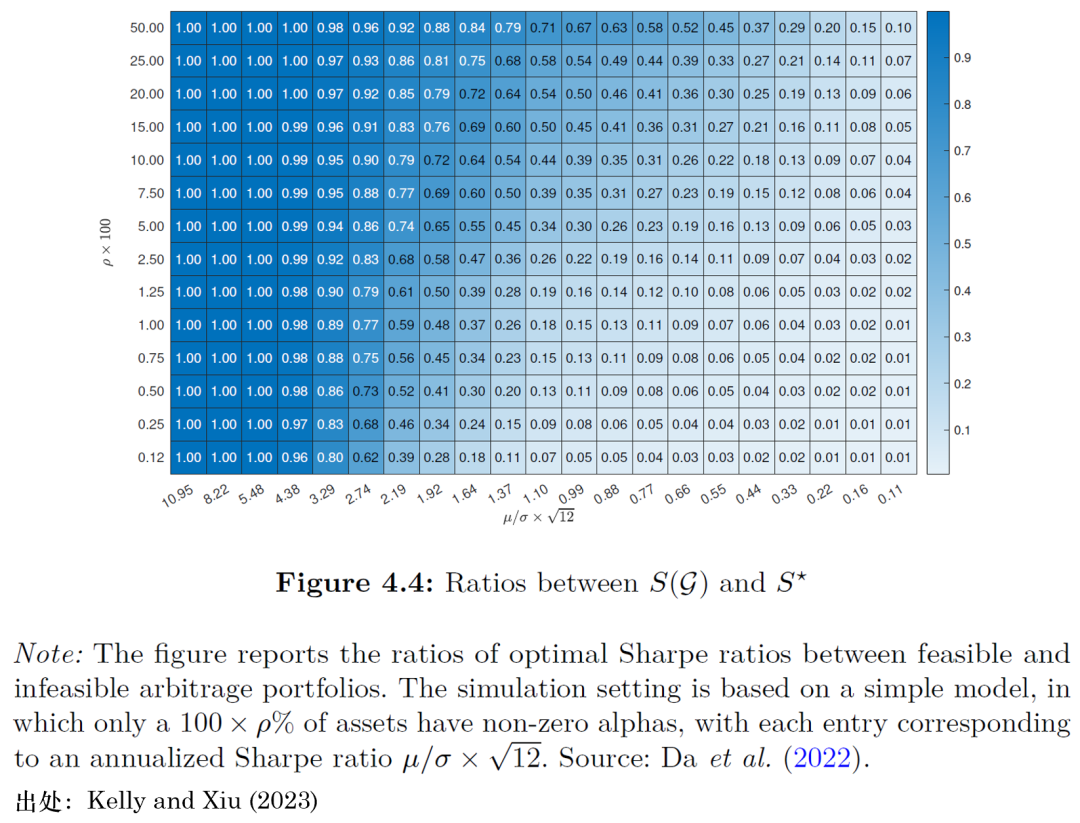

4.6.1 Alpha 检验和经济重要性

4.6.2 多重假设检验

参考文献

Ait-Sahalia, Y., J. Jacod, and D. Xiu (2021). Continuous-time Fama-MacBeth regressions. Tech. rep. Princeton University and the University of Chicago.

Ait-Sahalia, Y., I. Kalnina, and D. Xiu (2020). High frequency factor models and regressions. Journal of Econometrics 216(1), 86-105.

Ait-Sahalia, Y. and D. Xiu (2017). Using principal component analysis to estimate a high dimensional factor model with high-frequency data. Journal of Econometrics 201(2), 384-399.

Ait-Sahalia, Y. and D. Xiu (2019). Principal component analysis of high frequency data. Journal of the American Statistical Association 114(525), 287-303.

Andersen, T. G. and T. Bollerslev (1998). Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review 39(4), 885-905.

Andersen, T. G., T. Bollerslev, F. X. Diebold, and P. Labys (2001). The distribution of exchange rate realized volatility. Journal of the American Statistical Association 96(453), 42-55.

Bajgrowicz, P. and O. Scaillet (2012). Technical trading revisited: False discoveries, persistence tests, and transaction costs. Journal of Financial Economics 106(3), 473-491.

Barndorff-Nielsen, O. E. and N. Shephard (2002). Econometric analysis of realized volatility and its use in estimating stochastic volatility models. Journal of the Royal Statistical Society Series B (Statistical Methodology) 64(2), 253-280.

Barras, L., O. Scaillet, and R. Wermers (2010). False discoveries in mutual fund performance: Measuring luck in estimated alphas. Journal of Finance 65(1), 179-216.

Benjamini, Y. and Y. Hochberg (1995). Controlling the false discovery rate: a practical and powerful approach to multiple testing. Journal of the Royal Statistical Society Series B (Methodological) 57(1), 289-300.

Bickel, P. J. and E. Levina (2008a). Covariance regularization by thresholding. Annals of Statistics 36(6), 2577-2604.

Bickel, P. J. and E. Levina (2008b). Regularized estimation of large covariance matrices. Annals of Statistics 36(1), 199-227.

Bollerslev, T., S. Z. Li, and V. Todorov (2016). Roughing up beta: Continuous versus discontinuous betas and the cross section of expected stock returns. Journal of Financial Economics 120(3), 464-490.

Bollerslev, T., M. C. Medeiros, A. Patton, and R. Quaedvlieg (2022). From zero to hero: Realized partial (co)variances. Journal of Econometrics 231(2), 348-360.

Cai, T. and W. Liu (2011). Adaptive thresholding for sparse covariance matrix estimation. Journal of the American Statistical Association 106(494), 672-684.

Connor, G., M. Hagmann, and O. Linton (2012). Efficient semiparametric estimation of the Fama–French model and extensions. Econometrica 80(2), 713-754.

Corsi, F. (2009). A simple approximate long-memory model of realized volatility. Journal of Financial Econometrics 7(2), 174-196.

Da, R., S. Nagel, and D. Xiu (2022). The statistical limit of arbitrage. Tech. rep. Chicago Booth.

Didisheim, A., S. Ke, B. Kelly, and S. Malamud (2023). Complexity in factor pricing models. Tech. rep. Yale University.

Fama, E. F. and K. R. French (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33(1), 3-56.

Fama, E. F. and K. R. French (2015). A five-factor asset pricing model. Journal of Financial Economics 116(1), 1-22.

Fama, E. F. and K. R. French (2010). Luck versus skill in the cross-section of mutual fund returns. Journal of Finance 65(5), 1915-1947.

Fan, J., Y. Fan, and J. Lv (2008). High dimensional covariance matrix estimation using a factor model. Journal of Econometrics 147(1), 186-197.

Fan, J., A. Furger, and D. Xiu (2016a). Incorporating global industrial classification standard into portfolio allocation: A simple factor-based large covariance matrix estimator with high frequency data. Journal of Business and Economic Statistics 34(4), 489-503.

Fan, J., Y. Liao, and M. Mincheva (2013). Large covariance estimation by thresholding principal orthogonal complements. Journal of the Royal Statistical Society Series B (Statistical Methodology) 75(4), 603-680.

Fan, J., Y. Liao, and J. Yao (2015). Power enhancement in high-dimensional cross-sectional tests. Econometrica 83(4), 1497-1541.

Fan, J., Y. Liao, and W. Wang (2016b). Projected principal component analysis in factor models. Annals of Statistics 44(1), 219-254.

Gibbons, M. R., S. A. Ross, and J. Shanken (1989). A test of the efficiency of a given portfolio. Econometrica 57(5), 1121-1152.

Giglio, S., Y. Liao, and D. Xiu (2021a). Thousands of alpha tests. Review of Financial Studies 34(7), 3456-3496.

Gu, S., B. T. Kelly, and D. Xiu (2021). Autoencoder asset pricing models. Journal of Econometrics 222(1), 429-450.

Harvey, C. R. and Y. Liu (2020). False (and missed) discoveries in financial economics. Journal of Finance 75(5), 2503-2553.

Harvey, C. R., Y. Liu, and H. Zhu (2016). ... and the cross-section of expected returns. Review of Financial Studies 29(1), 5-68.

Jensen, T. I., B. Kelly, and L. H. Pedersen (2023). Is there a replication crisis in finance? Journal of Finance 78(5), 2465-2518.

Kelly, B. T., S. Malamud, and K. Zhou (2022a). Virtue of complexity in return prediction. Tech. rep. Yale University.

Kim, S., R. Korajczyk, and A. Neuhierl (forthcoming). Arbitrage Portfolios. Review of Financial Studies.

Kosowski, R., A. Timmermann, R. Wermers, and H. White (2006). Can mutual fund “stars” really pick stocks? New evidence from a bootstrap analysis. Journal of Finance 61(6), 2551-2595.

Ledoit, O. and M. Wolf (2004). Honey, I shrunk the sample covariance matrix. Journal of Portfolio Management 30(4), 110-119.

Ledoit, O. and M. Wolf. (2012). Nonlinear shrinkage estimation of large-dimensional covariance matrices. Annals of Statistics 40(2), 1024-1060.

Li, S. Z. and Y. Tang (2022). Automated risk forecasting. Tech. rep. Rutgers, The State University of New Jersey.

Lo, A. W. and A. C. MacKinlay. (1990). Data-snooping biases in tests of financial asset pricing models. Review of Financial Studies 3(3), 431-467.

Pesaran, H. and T. Yamagata (2017). Testing for alpha in linear factor pricing models with a large number of securities. Tech. rep.

Ross, S. A. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory 13(3), 341-360.

Shanken, J. (1992a). On the estimation of beta pricing models. Review of Financial Studies 5(1), 1-33.

Sullivan, R., A. Timmermann, and H. White (1999). Data-snooping, technical trading rule performance, and the bootstrap. Journal of Finance 54(5), 1647-1691.

White, H. (2000). A reality check for data snooping. Econometrica 68(5), 1097-1126.

版权声明:文章版权归原作者所有,部分文章由作者授权本平台发布,若有其他不妥之处的可与小编联系。